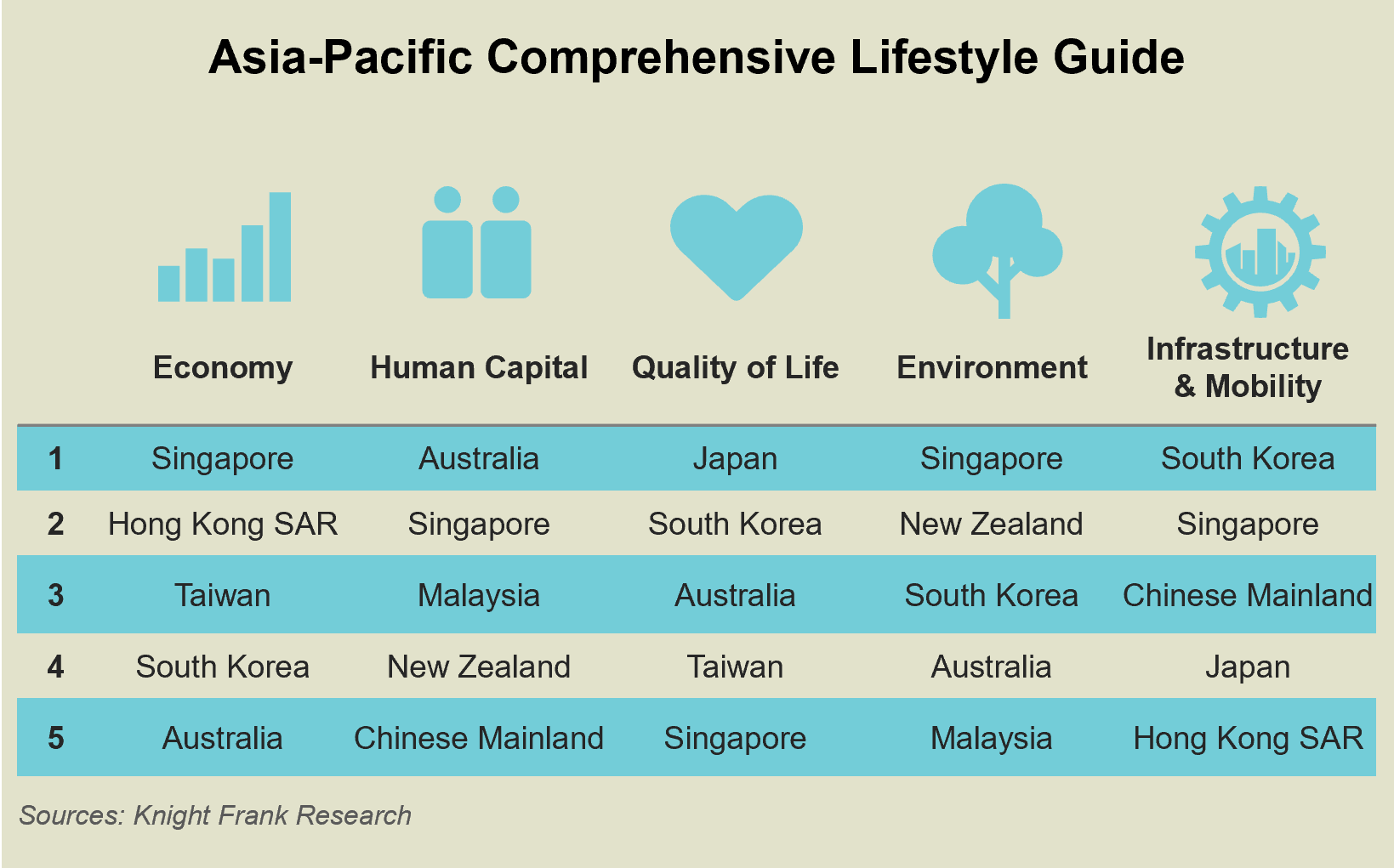

Knight Frank’s “Quality Life-ing” Report has identified Asia-Pacific as a premier lifestyle and investment destination, with Singapore standing out for individuals considering relocation. In our latest report, “Quality Life-ing: Mapping Prime Residential Hotspots” report, we evaluate 15 prominent markets based on five leading indicators: Economy, Human Capital, Quality of Life, Environment, and Infrastructure and mobility. This comprehensive analysis aims to assist prospective movers in identifying the ideal location that aligns with their specific needs and preferences. Singapore, Australia, Japan and Malaysia lead the rankings as Asia-Pacific’s leading lifestyle and investment hotspots according to this comprehensive analysis.

Kevin Coppel, managing director at Knight Frank Asia-Pacific, shares:

“As global wealth shifts and geopolitical landscapes evolve, affluent individuals are seeking prime residential hotspots that provide both lifestyle benefits and financial security. Markets like Singapore, Japan, and Australia continue to attract the world’s most discerning investors, offering not only strong economic fundamentals but also exceptional quality of life, infrastructure, and mobility. In this rapidly changing environment, Asia-Pacific remains a key destination for those looking to secure their wealth and future-proof their legacy.”

Christine Li, head of research at Knight Frank Asia-Pacific, adds:

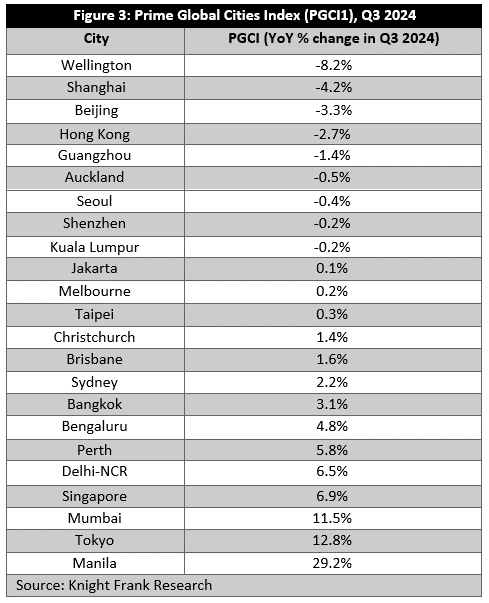

“The strong correlation between stock market performance and residential price growth in key Asia-Pacific markets further reflects the wealth effect at play. Japan’s stock market reached an all-time high in 2024, accompanied by a surge in Tokyo’s residential prices. Regional efforts to attract global talent and well-capitalised individuals through targeted visa programs are also adding momentum to Asia-Pacific’s housing markets. For instance, Thailand’s 25% increase in property transfers to foreign buyers, primarily from the Chinese mainland, underscores this policy impact in fostering resilient demand across the region.”

Leading destinations in Asia-Pacific

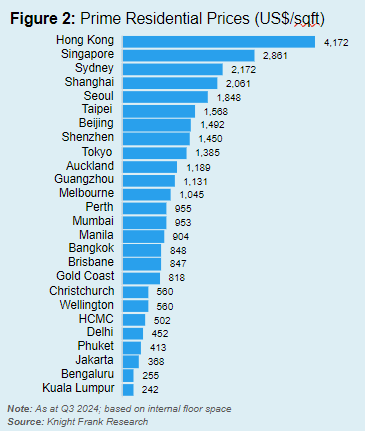

- Singapore: Recognised for its stability and development, Singapore emerged the top destination as it ranks among the top five in all indicators. Its robust economy, marked by political stability and a skilled workforce, makes it an attractive destination for businesses and individuals. In Q3 2024, prime residential prices rose 6.9% year-on-year, making it the second most expensive market in Asia-Pacific (Figure 2, at 2,861 US$ per square feet (psf)), 31% cheaper than Hong Kong (US$4,172 psf), but still ahead of Sydney (US$2,172 psf), Shanghai (US$2,061 psf) and Seoul (US$1,848 psf). The city-state’s economic fundamentals remain strong, with low unemployment and projected GDP growth of 1-3% for 2024. Additionally, the Family Office sector has surged from 400 in 2020 to 1,650 by August 2024, reinforcing its status as a global wealth management hub.

- Australia: Australia is the second most desirable location for investments and relocations, as it came in top 5 for four out of the five indicators in our study. In Q3 2024, major cities like Sydney experienced a 2.2% year-on-year price increase, supported by cash buyers and limited property supply. Despite rising interest rates, Australian cities continue to show positive price trends. The country’s diverse landscapes cater to various lifestyles, with cities like Perth seeing significant population growth of 3.6% in FY2023. Sydney continues to be the financial capital, home to over a third of Australia’s ultra-high-net-worth individuals, and Melbourne ranks highly for quality of life, excelling in healthcare and education retaining the top spot in Australia as the EIU’s most liveable city in 2024. Overall, Australia’s attractive residential market and enviable lifestyle continue to draw investors, expatriates, and international students from around the globe.

- Japan: Japan excels in Quality of Life and Infrastructure & Mobility aspects, boasting a high life expectancy and sophisticated transportation network. With modest economic growth projected at 0.9% for 2024, rising wages are expected to enhance consumer spending. The Tokyo residential market has shown resilience, with prices increasing over 20% since Q1 2022 and an annual rise of 12.8% noted in Q3 2024 (for the full breakdown, please click here), making it the second best-performing market in Asia-Pacific. This growth is fuelled by high demand for luxury condominiums amid limited supply. Additionally, Japan’s stock market reached an all-time high this year, attracting substantial foreign investment as Tokyo’s population continues to grow with an influx of foreign residents and investors.

The Asia-Pacific residential market is poised to remain attractive to HNWIs, expatriates, and investors due to its strong price resilience amid global economic uncertainties, with safe-haven markets like Singapore, Australia, and Japan leading the way. The region’s sustained economic growth and rising affluence are expected to drive stable price growth and returns, particularly as 19 megacities are projected to emerge by 2030, intensifying housing demand. Additionally, the middle-class population in Asia-Pacific is anticipated to reach 1.7 billion by 2030, prompting a significant rise in demand for affordable housing, especially in emerging markets like Vietnam and Indonesia. Furthermore, there is a noticeable shift toward branded residences in the prime market especially in markets such as Australia, India, and Thailand, appealing to both local and international investors who value luxury living combined with high-end services on top of secure investments.

The Asia-Pacific residential market is poised to remain attractive to HNWIs, expatriates, and investors due to its strong price resilience amid global economic uncertainties, with safe-haven markets like Singapore, Australia, and Japan leading the way. The region’s sustained economic growth and rising affluence are expected to drive stable price growth and returns, particularly as 19 megacities are projected to emerge by 2030, intensifying housing demand. Additionally, the middle-class population in Asia-Pacific is anticipated to reach 1.7 billion by 2030, prompting a significant rise in demand for affordable housing, especially in emerging markets like Vietnam and Indonesia. Furthermore, there is a noticeable shift toward branded residences in the prime market especially in markets such as Australia, India, and Thailand, appealing to both local and international investors who value luxury living combined with high-end services on top of secure investments.